Zoom, specific or systematic risk?

An analysis of the teleconferencing company's situation

It was certainly not the announcement on December 5, 2019 of the third quarter 2019 results that propelled Zoom’s action to the top. The near doubling of sales and gross margin is entirely consumed by the correlative increase in operating expenses, particularly commercial expenses, and the operating result is stable, slightly negative.

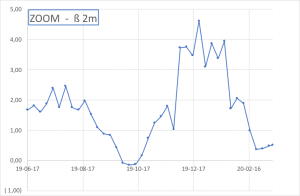

Since its IPO in mid-April 2019, Zoom has experienced a “traditional” trajectory for a technology company: a high ß, close to 2, followed by a significant loss of correlation with the market, before envisaging the start of a stabilized trajectory. You will recall that the ß is an econometric translation of the correlation of a stock relative to the benchmark index (the Nasdaq in this case) and economically the sensitivity of the firm to macroeconomic conditions.

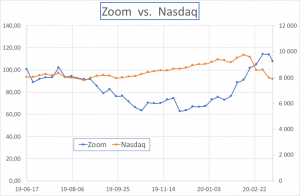

The first graph shows the evolution of the Nasdaq and Zoom since the latter went public.

Graph 1: Zoom and Nasdaq April 2019-March 2020

The second, which is a direct consequence of the first, is the Zoom ß calculated on a weekly basis and over a sliding period of 2 months.

Graph 2: ß (weekly, 2-month rolling period) of Zoom

Even though the two firms are very different, Zoom’s stock market trajectory resembles that of Facebook, which quickly lost 30% of its value to regain its IPO price after 8 months of listing. Like Facebook, Zoom experienced a period of negative ß. This obviously does not reflect a negative risk premium, but rather a specific type of trajectory: the Nasdaq rises, Zoom falls, the ß is negative… Then, Zoom regains its colours and the Nasdaq continues to rise, then the ß becomes stratospheric… The observation is interesting, but is purely econometric.

The most remarkable phenomenon has been observed for about 7 weeks. The evolution of COVID19 has not yet produced its effects on the stock markets, the stock market crash only starting on 21 February. On the other hand, Zoom will see its share price rise by $70 on January 27th to reach a peak of $125 on March 5th, before falling back to $107 on March 13th. Forced or voluntary isolation, telecommuting and limited contact have shown the tremendous tool that videoconferencing is and Zoom, among others, has gained business credibility with clients and markets alike.

What will happen now? The company has just published (March 4) its 4th quarter results: strong sales growth, positive operating income, significant cash generation… and $10 more in the share price, immediately lost in the wake of the Nasdaq. After an individual and therefore specific recovery, will Zoom’s trajectory become collective and systematic? With what sensitivity in the long term?