Unilever: activism, ESG and returns

The growing phenomenon of shareholder activism

By Ivan Cuesta

Due to their low financial performances, the leading consumer staples have been confronted with shareholders’ activism for the last five years. Nestle and P&G in 2017, Danone in 2017 and 2021, Campbell Soup in 2018, and Unilever in January 2022 managed different activists’ events. Unilever, the last company joining the club of activists’ targets, was supposed to be away from being a prey by having initiated “internal activism” after the bid of KraftHeinz in 2017. So why did the activist hedge fund Trian Partners enter the capital of the Dove maker?

The academic literature identifies the profile of activists’ targets. Target companies present at least one of these characteristics:

Lower Total Shareholders’ Returns than peers on short or long-term;

Lower operating performances than peers on short or long-term;

Agency issues at the governance.

Unilever doesn’t show obvious governance issues, so let’s concentrate on shareholders’ return and operating performance.

Total Shareholders’ Returns (TSR)

We selected the benchmark pool is as follows: Nestle, Reckitt Benckiser, Beiersdorf, Danone and Mondelez.

On a 1-year TSR, we can observe a significant underperformance of Unilever towards its peers. On a 3-year TSR, Unilever belongs to the lowest performers together with Danone, Beiersdorf, and Reckitt Benckiser. On the 5-year TSR, Unilever belongs to the highest performers with Nestle and Mondelez.

We might conclude that even though the situation looks fine in the long-run, there is a growing deterioration in Unilever’s credibility.

Operating performances: Return on Assets (ROA)

Different indicators can be selected to observe the dynamics of operating performances. We selected the Return-On-Assets (ROA) which is calculated by dividing the Net Income by the Total Assets.

Regarding the ROA, the performances of Unilever are on the top of the benchmark, which means that this KPI might not have been a trigger for the Trian Partners’ activist event. The ROA performance can come from a constant increase in net income and/or the reduction of assets. In this case, the ROA performance of Unilever comes from its continuous growth of net income, while the total assets keep on slowly increasing over the past years, except in 2018 after the divestment of the margarine business.

When a firm shows satisfactory operating returns and low market credibility, it means that investors don’t trust the resilience of the operating performance.

We can measure the relative market value creation using an indicator named Tobin’s Q, under the name of the famous economist, which is calculated by dividing the Enterprise Value (EV = market capitalization + net interest-bearing debt) by capital employed (CE).

Capital employed is the funds invested in the business operations and EV is the value of these funds. If Tobin’s Q is greater than 1, we observe value creation (EV > CE), less than 1, value destruction.

Without getting to much into technicalities, financial mathematics provide a formula which calculates the implicit growth rate of the free cash flows generated by the firm combining its performance (ROCE after tax vs. WACC) and its market evaluation (Tobin’s Q).

Technically, the implicit free-cash-flow growth (g) is calculated as follows:

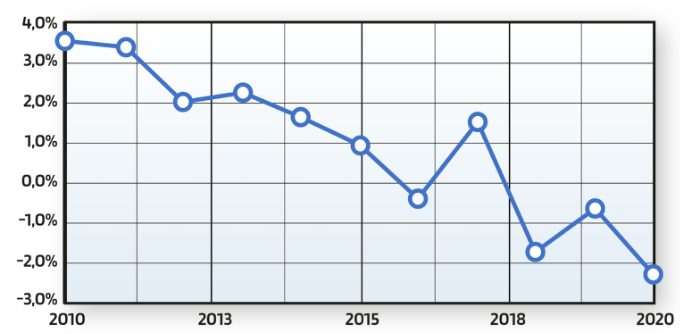

Now, we can plot on a graph the evolution of this implicit growth throughout the years:

Implicit Free Cash Flow Growth

We can observe for Unilever a constant decrease of investors’ expectations towards the ability of the management to keep a positive free cash flow growth. The positive jump in 2017 was due to the consequences of the KraftHeinz bid, which provoked internal activism at Unilever. This internal activism led to the divestment of the margarine and tea businesses, to share buyback programs, dividend increases, and operating performances targets. But despite the internal activism, the investors no longer believe in positive outcomes from Free Cash Flow perspectives, which puts the company’s management in a credibility issue towards investors.

Paul Polman was CEO of Unilever from 2009 to 2019 and is regarded as a champion for promoting ESG actions at Unilever. The impact of some sustainable development initiatives promoted by Polman might be questioned, but obviously he failed in convincing investors that the current level of operating performance was enduring and resilient.

The “internal activism” was not the right response to investors, while selling problematic activities to private equity, like the tea business, instead of solving their sustainability issues doesn’t seem to be the right move, too.

Epilogue (?)

When Trian invested in Unilever earlier this year, the activist’s event created an abnormal return of 3.83% after 10 days from the event and 6.69% after 20 days[1]. Investors were first supporting the activist’s event considering that it was then in the hands of the management to build a real activist plan aligned with Trian Partners to catch up in terms of TSR and Expected Cash Flow Growth. Then, everything became “normal” again, and the current geopolitical circumstances, making market indexes drop, might put even more Unilever on the radar of potential hostile bids again.

______________

[1] To measure the « abnormal return » you multiply the stock market return over a period by the company’s ß and you get the return it should have “normally” generated. When the “actual” return differs from the “normal”, there is an abnormal return which, when the difference is positive shows the satisfaction of the investors (when negative, disappointment…). Unilever’s ß for the calculation is estimated at 0.45 (our calculation).