Happy birthday!

Back to inflation and brands…

By Dominique Jacquet

(Image created through AI via Bing Image Creator)

We have just celebrated the thirtieth anniversary of an event that made an impression (at the time) in the fast-moving consumer goods sector, Marlboro Friday.

This is not a “flash” sale of products on an e-commerce site, but the announcement made by Philip Morris of a 20% drop (40cts from $2.15) in the price of sale of its flagship premium product, well known for the advertisement showing a cowboy lighting his cigarette by striking a match on his cheek…

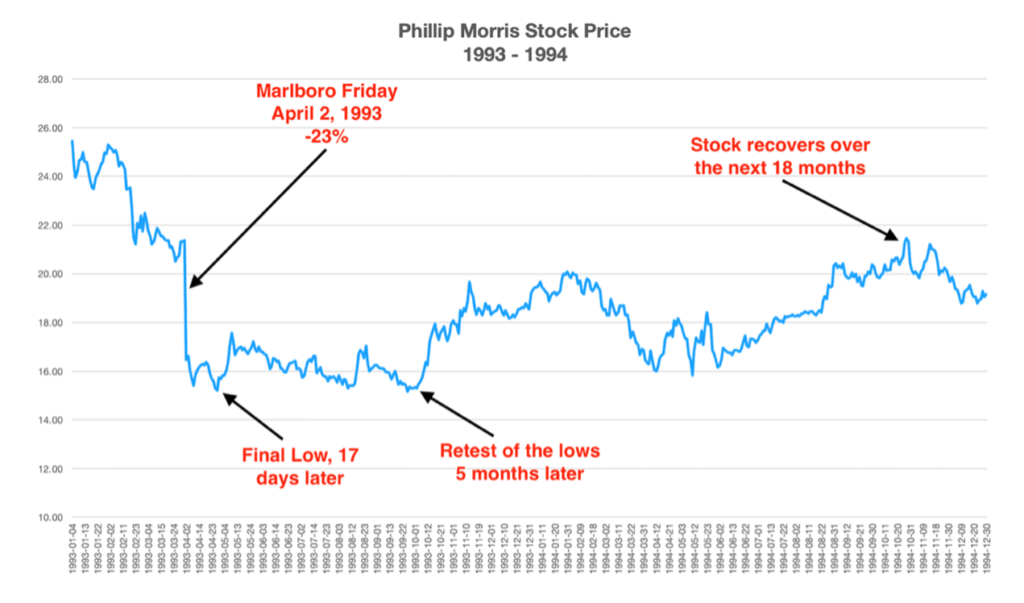

The financial market immediately reacted by turning into smoke (a bad pun…) a little more than 13 billion dollars in market value, the price of Philip Morris falling by 23%.

For history, the original Black Friday dates from September 24, 1869 and was the consequence of a speculation transformed into a disaster, for speculators as well as for the market. The 1929 crisis saw the combination of Black Thursday, Monday and Tuesday (minus 36% for the 3 days, minus 89% for the total crisis…). The year 1987 saw a Black Monday at minus 22.6%, the subprime crisis having generated a drop in the indices of 10% on Friday, October 10.

Back to Marlboro.

The economic crisis of the early 90s was a tough test for brands. Consumers, noticing the significant and lasting decline in their purchasing power, have gradually turned to lower-cost discount products.

The dilemma for a company like Philip Morris was:

- Either, wait for the end of the crisis, hoping that customers will resume their previous consumption habits, PM recovering customers, volumes and market share,

- Or, consider that customers were irreversibly lost, and hit a high cost to bring them home immediately, waiting for the end of the crisis to increase selling prices and associated margins again.

Clearly, PM opted for the second interpretation and agreed to lose short-term margins in order to retain its customers, considering that their departure would be irrevocable.

A month after the decision, the well-known Fortune Magazine analyzes the decision and considers it to be even worse than the launch of New Coke…

But, 18 months later, the firm regained its pre-crisis share price and Marlboro its market share of 30% (20% in April 1993).

(Graphic source : DataTrek Research)

The considerable attention paid by many financial and economic experts to short-term results often causes them to lose sight of the fact that a company’s wealth and sustainability come from its ability to attract and retain customers.

Today, cost inflation leads companies to use the power of their brands to impose an increase in selling prices on consumers in order to announce to capital markets a growth in sales accompanied by the resilience of margins.

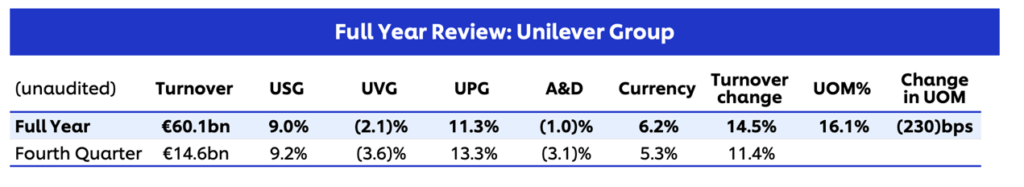

Presenting Unilever’s results for the year 2022, its CEO, Alon Jope describes the evolution of revenues and shows that the organic growth (USG) of 9% was achieved thanks to an increase in prices (UPG) of 11 .3% and to the detriment of a loss of volume (UVG) of 2.1%… The 4th quarter even saw the acceleration of the phenomenon.

What can be said about the “usefulness” of brands which makes it possible to impose this transfer of wealth from customers to the company? Will the firm find its client portfolio intact in the future? What about Sustainable Value Creation?