Sustainability and value creation

What's next after 7 years of fat cows for Facebook!

By Dominique Jacquet

Just a year ago, the first educational film was posted on the platform, which was dedicated to Facebook and questioned the lasting pursuit of a 7-year period of fat cows.

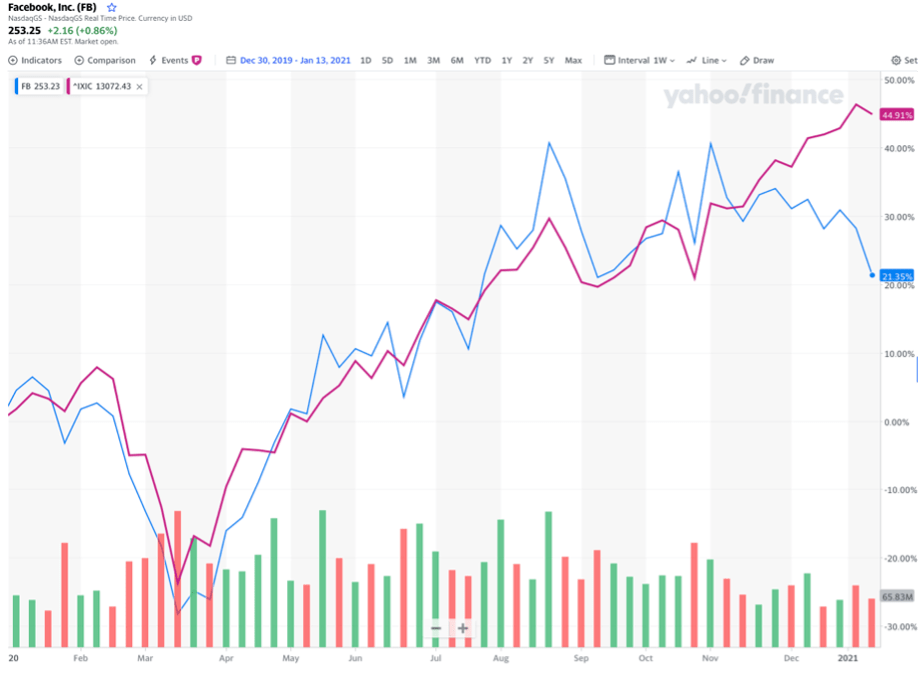

The year 2020 was not lacking in animation (…) and it is interesting to observe the comparative evolution of the firm and its benchmark, the Nasdaq.

The following graph (source: Yahoo.finance, Facebook is in blue, Nasdaq in red) will elicit some comments:

Facebook’s trajectory (in blue) closely follows the Nasdaq (in red) until November and then stalls after the announcement of Q3 results on October 29. Compared to Q3 2019, Q3 2020 sales are up, but by 22% instead of 29% for the previous year, commercial profitability (EBIT to turnover) is equal to 37% (41% in 2019, 42% in 2018), free cash flow is up 7% instead of 30%, etc. Conclusion, a slowdown in the prospects for profitable growth, and therefore of value creation, which is reflected in the stock price. The financial rationality therefore applies to Facebook which is not surprising. Even less a surprise: trees do not rise to the sky!

On the other hand, it is astonishing to note that the previous valuations of the firm could only be justified by increasing the size of trees in a reckless and illusory manner, as if the exceptional profitability of the firm and its growth prospects could not be troubled by any disturbance: the arrival of competitors attracted by the prospects of a solvent and growing market, the company itself which believes it is indestructible, or any other reason.

Anyone who has been involved in a business valuation knows the importance of the terminal value in the construction of the model: we take the last free cash flow and we make it grow ad infinitum on the basis of the sustainability of the business model and financial performance. What optimism at the time of the transaction and what disappointments later …

More pleasing, but anecdotal, the stratospheric and ephemeral stock market performance of Signal Advance, whose share price sky-rocketed from $ 7 to $ 42 on January 11 and fell back to $ 15 the next day when buyers realized they had confused two firms: Elon Musk strongly recommended the use of Signal encrypted messaging, distributed by a nonprofit organization, and there was a misunderstanding of the name… When the reflex replaces the brain…

If the investors had interpreted the tweet “Use Signal” from an oral perspective, they would perhaps have multiplied by 6 the price of Unilever, producer since 1961 of the eponymous toothpaste …

The whole E-Cademy team sends you its best wishes for health and happiness for 2021 !!!!